Sattva Hamlet Cost Sheet

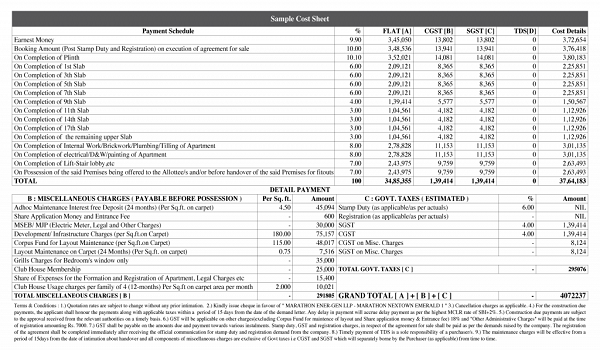

The Sattva Hamlet Cost Sheet provides a clear breakdown of all charges associated with purchasing an apartment unit at the project. It covers the base cost, applicable taxes, stamp duty & registration fees, customisation charges, and any additional levies. This format will help you understand each component before making an informed decision.

Here is the detailed Charge Descriptions included in the Sattva Hamlet Cost Sheet:

Base Cost: The base cost is the main price of the apartment. It covers the construction and basic finish. It does not include extra fees. Here are the starting base prices:

- Studio (655 sq ft): INR 55 lakhs

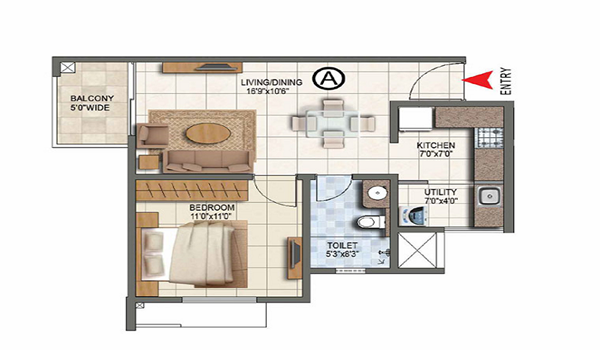

- 1 BHK (776–820 sq ft): INR 65 lakhs

- 2 BHK (1,323 sq ft): INR 1.45–1.52 crores

- 2.5 BHK (1,160–1,170 sq ft): INR 1.5 crores

- 3 BHK (1,916 sq ft): INR 2.10–2.20 crores

- 3.5 BHK (2,239 sq ft): INR 2.46–2.57 crores

- 4 BHK (2,895 sq ft): INR 3.18–3.32 crores

Goods and Services Tax (GST): All residential purchases attract a GST of 5% on the base cost. This amount is payable at the time of sale and appears as a separate line item in one's invoice.

Stamp Duty and Registration: Stamp duty varies by state but generally falls between 5% and 7% of the property’s value. Registration charges are approximately 1%. Both fees must be paid when the sale deed is executed & registered with the local authority.

Customization Charges: Buyers may choose optional enhancements—such as designer flooring, upgraded sanitary fittings, or custom wardrobes. Each option carries a fixed charge provided by the builder. These charges are payable before construction completion.

- Club Membership Deposit: Refundable deposit for access to clubhouse facilities.

- Car Parking: Separate cost for covered or open parking slots.

- Maintenance Advance: Prepaid fund for estate upkeep.

- Utility Connection Fees: Charges for electricity, water, and internet connections.

- Safety Equipment Fee: Fire-fighting and security installations.

For a 2 BHK unit priced at ₹1,48,00,000 (mid-range):

- Base Cost: ₹1,48,00,000

- GST (5%): ₹7,40,000

- Stamp Duty (6%): ₹8,88,000

- Registration (1%): ₹1,48,000

- Customization: (e.g., ₹2,00,000)

- Additional Charges: (e.g., ₹1,50,000)

- Total Estimated Cost:

- ₹1,48,00,000 + ₹7,40,000 + ₹8,88,000 + ₹1,48,000 + ₹2,00,000 + ₹1,50,000

- = ₹1,69,26,000

| Enquiry |